Contemplating coverage?

Subscribe to receive our emails & get

$200 OFF!

Have questions?

Call us: (833) 544-8273

Written By Erin Easley

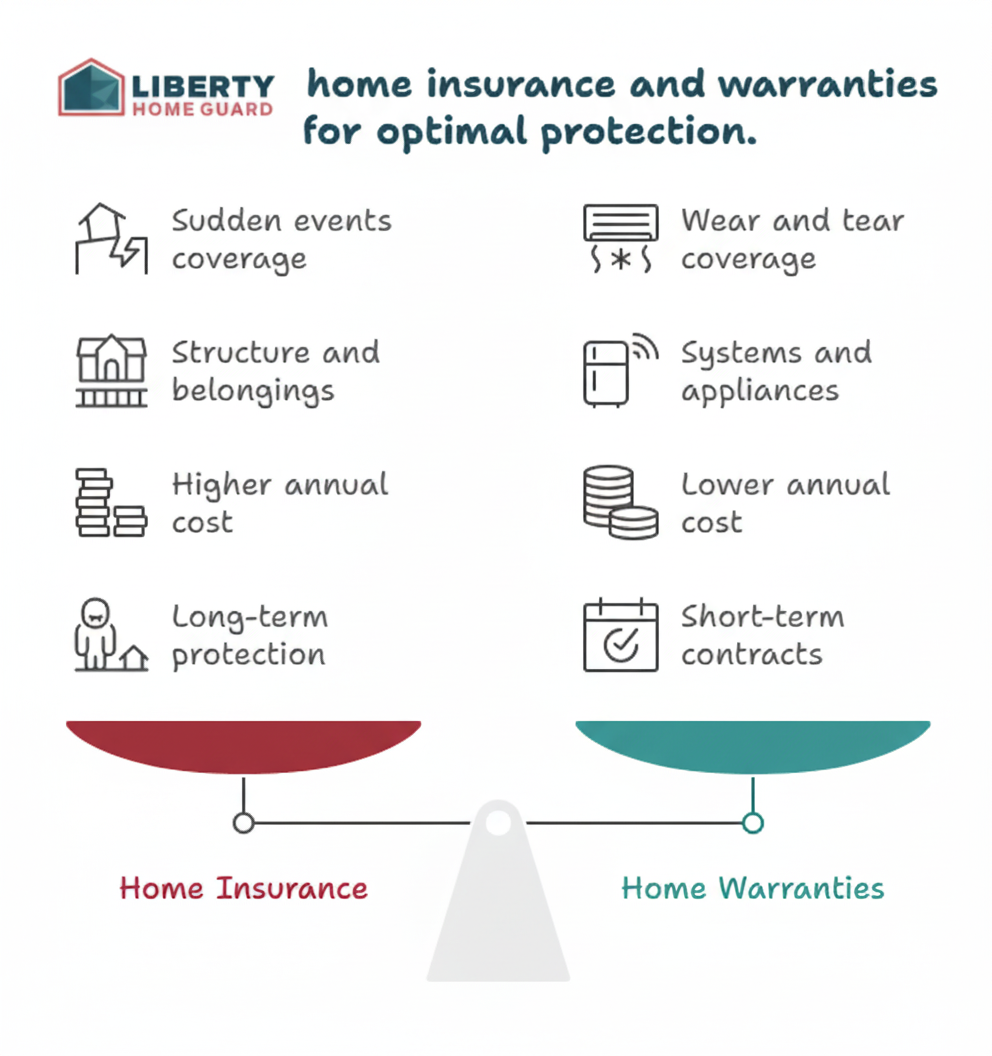

As a homeowner, protecting your investment is crucial, but understanding the different types of coverage available can be confusing. Two of the most common protection options are home insurance and home warranties, and while they both provide financial security, they serve distinctly different purposes.

Many homeowners mistakenly believe these two types of coverage overlap or that having one makes the other unnecessary. In reality, home insurance and home warranties complement each other perfectly, covering different aspects of homeownership risks. Understanding the differences between them can help you make informed decisions about protecting your home and budget.

Home insurance, also known as homeowners insurance, is a property insurance policy designed to protect your home's structure and your personal belongings from unexpected damage or loss. Most mortgage lenders require homeowners insurance as a condition of the loan, making it essentially mandatory for most homebuyers.

A standard home insurance policy typically includes several types of coverage:

Dwelling Coverage: Protects the physical structure of your home, including walls, roof, floors, and built-in appliances, from covered perils like fire, lightning, windstorms, and hail.

Personal Property Coverage: Covers your belongings inside the home, such as furniture, clothing, electronics, and other personal items, if they're damaged or stolen.

Liability Protection: Provides financial protection if someone is injured on your property or if you accidentally damage someone else's property.

Additional Living Expenses: Covers temporary housing costs if your home becomes uninhabitable due to a covered event.

Home insurance operates on a "named perils" basis, meaning it only covers damage from specific events listed in your policy. Common covered perils include fire, theft, vandalism, lightning strikes, and certain weather events. However, damage from floods, earthquakes, or normal wear and tear typically isn't covered under standard policies.

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances when they break down due to normal wear and tear. Unlike insurance, which protects against sudden, unexpected damage, a home warranty addresses the inevitable breakdowns that occur as your home's components age.

Home warranties typically cover:

Major Appliances: Refrigerators, dishwashers, washers, dryers, ovens, ranges, and garbage disposals

Home Systems: HVAC systems, electrical systems, plumbing, and water heaters

Optional Add-ons: Pool equipment, septic systems, well pumps, and additional appliances

When a covered item breaks down, you contact your home warranty company, pay a service fee (usually $75-$125),and a licensed technician will diagnose and either repair or replace the item according to your contract terms.

The fundamental difference between home insurance and home warranties lies in what causes the damage and what gets covered:

Home Insurance responds to sudden, unexpected events like storms, fires, theft, or accidents. If a tree falls on your roof during a storm, home insurance covers the repairs.

Home Warranties cover breakdowns due to normal wear and tear. If your 10-year-old air conditioner stops working on a hot summer day, a home warranty handles the repair or replacement.

Home Insurance primarily covers your home's structure and your personal belongings. It protects against catastrophic losses that could financially devastate you.

Home Warranties focus on the mechanical systems and appliances that make your home functional. They protect against the ongoing costs of maintaining an aging home.

Home Insurance involves paying annual premiums (typically $1,200-$2,000 per year) and a deductible (usually $500-$2,500) when you file a claim.

Home Warranties cost $300-$700 annually with smaller service fees ($75-$125) each time you use the service.

Home Insurance is ongoing protection that you maintain as long as you own your home. It provides comprehensive coverage for major financial losses.

Home Warranties are typically annual contracts that focus on preventing smaller, but frequent, repair expenses from adding up.

The cost of home insurance varies significantly based on several factors:

Average Annual Cost: According to recent data, the national average for homeowners insurance is approximately $1,400 per year, though this can range from $800 to $3,000+ depending on location and coverage levels.

Factors Affecting Cost:

Ways to Lower Costs:

Home warranty costs are generally more predictable than insurance premiums:

Annual Contract Costs:

Service Call Fees: $75-$125 per visit, regardless of the repair cost

There's a reason Liberty Home Guard was rated the #1 Home Warranty

Service by U.S. News and World Report for 2021, 2022, 2023, and 2024. Check out our services.

Factors Affecting Cost:

Cost-Benefit Consideration: A single major appliance replacement (like a refrigerator or HVAC system) can cost $1,500-$5,000+, making the annual warranty cost worthwhile if you experience even one major breakdown.

For most homeowners, having both home insurance and a home warranty makes financial sense because they address different risks:

Home Insurance is Essential because:

Home Warranties are Valuable because:

Prioritize Home Insurance If:

Consider Adding a Home Warranty If:

The decision between home insurance and a home warranty isn't an either/or choice for most homeowners. Home insurance is typically mandatory and protects against major financial catastrophes, while home warranties provide ongoing protection against the inevitable costs of home maintenance.

Consider your home's age, the condition of your appliances and systems, your budget for unexpected repairs, and your comfort level with handling home maintenance issues. For many homeowners, the combination of both types of coverage provides comprehensive protection and peace of mind.

Ready to protect your home with a warranty that complements your existing insurance? Liberty Home Guard offers flexible plans designed to fit your specific needs and budget. Whether you need basic systems coverage or comprehensive protection for all your appliances, we provide reliable service when you need it most.

Contact our team at (866) 984-0012 or request a custom quote online to learn how a home warranty can provide the additional protection your home insurance doesn't cover.

There's a reason Liberty Home Guard was rated the #1 Home Warranty Service by U.S. News and World Report for 2021, 2022, 2023, and 2024. Check out our services.

Learn MoreHome insurance is a policy to protect your home and belongings from damage that occurs in certain circumstances. There isn’t a legal precedent for home’ insurance, but mortgage lenders typically require it for all properties to protect their investment if damaged before you pay it off.

While the terms of insurance policies vary, standard coverage protects your main dwelling, other structures on your property, and your personal belongings. They can also cover liability for damage to someone else’s property or injuries on your property. Home insurance is inherently restrictive, though. Many policies apply exclusively to named perils or circumstances explicitly outlined in your terms.

That’s where home warranties come in. When your everyday appliances and systems, such as dishwasher, garage door opener, HVAC unit, or electrical system malfunction due to routine use, you can file a home warranty claim. Like home insurance, you’ll pay a deductible, also known as a trade call or service call fee, for a licensed contractor to assess, diagnose, repair, or replace your malfunctioning item.

Stay Ahead of Potential

Home Mishaps!

Subscribe to our Liberty Home Guard Newsletter and gain access to exclusive content that ensures your peace of mind.