Contemplating coverage?

Subscribe to receive our emails & get

$200 off!

Have questions?

Call us: (833) 544-8273

Written By Allaire Conte

Buying a home is a major milestone, but it’s also a complex financial transaction filled with expenses many first-time buyers don’t anticipate. Beyond the sale price, there are dozens of hidden costs of buying a home that can catch you off guard if you’re not prepared.

Homeownership costs have surged more than 25% since 2020, far outpacing wage growth, according to CNET. If you're planning to buy a home in 2025, understanding these rising expenses is more important than ever. This guide will walk you through the hidden costs you need to plan for—and how to budget smartly for your new home.

Manage your client base and home warranty information

with our Real Estate Portal:

Closing costs are the fees both homebuyers and sellers pay to finalize a home sale. They can range from lender fees to title search and escrow fees, to appraisal charges and attorney fees, just to name a few. They may also include home warranty closing costs if the seller offers a policy transfer.

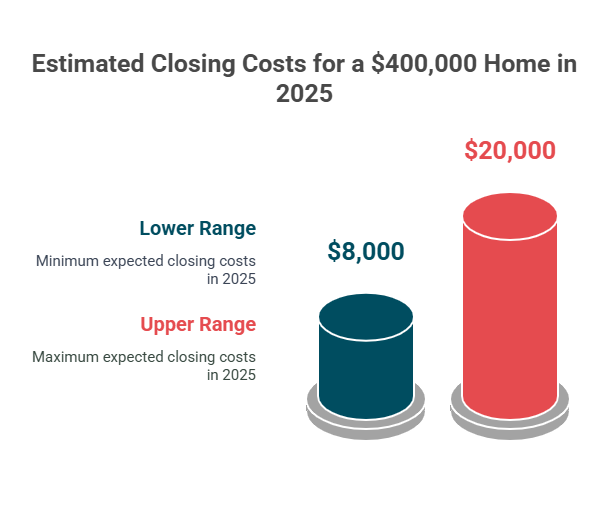

In 2025, buyers should expect closing costs to range from 2% to 5% of the home's purchase price. That means on a $400,000 home, closing costs could easily run between $8,000 and $20,000. If you're wondering "what if I can't afford closing costs?" there are options—like negotiating seller concessions, applying for closing cost assistance programs, or rolling costs into your mortgage. However, it’s crucial to plan for them upfront to avoid scrambling at the last minute.

If you’re confused about some of the terminology you’ll encounter, it helps to remember that "closing escrow" simply means finalizing the home sale by signing documents, transferring funds, and officially taking ownership. It's the last major milestone before you receive your keys.

A home inspection is one of the smartest investments you can make as a buyer. It's your chance to uncover hidden issues—like foundation cracks, plumbing leaks, or electrical problems—before you finalize the deal.

But who pays for the inspection when buying a house? In most cases, the buyer is responsible for the inspection cost. As of 2025, expect to pay anywhere from $300 to $600, depending on your location and the size of the home.

If the inspection uncovers major defects, you can often negotiate repairs or a price reduction with the seller. Skipping this step to save a few hundred dollars could cost you thousands later.

When you make an offer on a home, you'll likely need to provide an earnest money deposit—a good-faith payment that shows the seller you're serious.

This deposit is typically 1%–3% of the home's purchase price and is held in escrow until closing. If the sale goes through, the money is applied to your down payment or closing costs. But if you back out of the deal without a valid reason, the seller may have the right to keep your earnest money.

Budgeting for this deposit is crucial. While it’s not an extra cost in the long term, it does require cash on hand during a critical stage of the transaction.

Mortgage lenders require homeowners' insurance before closing on a property. The policy protects your home against risks like fire, theft, and weather damage.

Premiums can vary significantly based on location, property size, coverage limits, and your home's age. As of 2025, the average annual premium in the U.S. is around $1,400–$1,600, but it can be much higher in disaster-prone areas.

It’s smart to shop around for quotes early in the buying process. Some buyers are surprised to find out they must pay the first year’s premium upfront at closing, which adds to those hidden costs of buying a home.

Being aware of the hidden costs of purchasing a home is crucial for a successful and stress-free experience. By budgeting for closing costs, inspections, and other expenses, you can prepare yourself financially for the complete picture of homeownership. Understanding these hidden costs upfront allows you to make informed decisions, avoid financial surprises, and ensure a smooth transition into your new home.

The prospect of spending so much money out of pocket is no doubt anxiety-inducing. So what can buyers do to save some money? One option is to take advantage of a home warranty. Sellers or real estate agents may include a warranty with the sale of a home, but buyers can also purchase a policy on their own. It can ensure that any mishaps involving home appliances and systems, from refrigerators and water heaters to HVAC and plumbing, are swiftly resolved at an affordable price.

Peruse Liberty Home Guard’s blog to learn more about home warranties and their potential benefits. When you want to investigate a policy for your home, you can use our website for a free quote or call our team at (866)-432-1283.

Phantom costs refer to ongoing homeownership expenses that aren’t part of your mortgage, like property taxes, insurance, maintenance, and HOA fees.

The 20% rule suggests aiming for a 20% down payment to avoid private mortgage insurance (PMI) and secure better loan terms.

Extra costs include closing fees, inspections, appraisals, taxes, insurance, earnest money, HOA dues, and moving expenses.

Yes, buyers can often negotiate a lower price based on inspection findings, appraisal values, or market conditions.

Stay Ahead of Potential

Home Mishaps!

Subscribe to our Liberty Home Guard Newsletter and gain access to exclusive content that ensures your peace of mind.